17 Property Features That Are Now Raising Insurance Premiums Without Warning

When I first looked into homeowners insurance, I thought the biggest risk was forgetting to lock the front door, not my dreamy backyard pool.

Turns out, some of the coolest features we add to our homes can quietly crank up those premiums. From trampolines to solar panels, what seems like a great idea can make your insurer sweat.

I mean, who knew a treehouse could be a red flag? These property features may look amazing, but they could be draining your wallet.

1. Swimming Pools

You know the allure of a backyard oasis is undeniable which can turn any home into a holiday destination. However, insurance companies splash cold water on your poolside dreams due to liability risks.

Slippery tiles and diving boards can lead to accidents that make insurers wary. Besides the fun factor, maintaining a pool requires diligence or else it becomes a liability.

Think of it as a high-maintenance friend that demands constant attention. But fear not, with proper safety measures like fences and covers, you can still enjoy poolside bliss without sinking your finances.

2. Trampolines

Bouncing up and down on a trampoline brings out the inner child which is fun for all ages. Unfortunately, insurers see trampolines as risky business.

Injuries from a cheerful leap can lead to lawsuits which is why insurance companies increase premiums. The embodiment of joy and excitement can quickly turn to unexpected medical bills.

Even a safety net might not completely ease the tension with your insurer. Keep the fun alive by considering safer trampoline alternatives or making sure every jumper is supervised.

3. Wood-Burning Fireplaces

Crackling logs and the warmth of a fire bring coziness that nothing else compares to. Yet, insurers consider wood-burning fireplaces as a potential fire hazard.

Sparks and embers can lead to unintended blazes that make them cautious about covering homes with these features. Romantic evenings around the hearth might set your heart aflame but could also ignite your premiums.

Chimney inspections and regular maintenance can help mitigate risks. As the old saying goes, where there’s smoke, there’s fire, and potentially a higher insurance bill.

4. Old Roofs

Old roofs have character which tells stories of years gone by. However, they also tell insurers about potential leaks and structural issues.

The allure of antiquity fades when faced with the reality of water damage. Insurers might hike up premiums to cover the risks. Regular roof maintenance and timely replacements can alleviate concerns.

After all, a roof over your head should offer protection which should not be a source of constant worry. Keep your home’s crown in tip-top shape to keep the costs down.

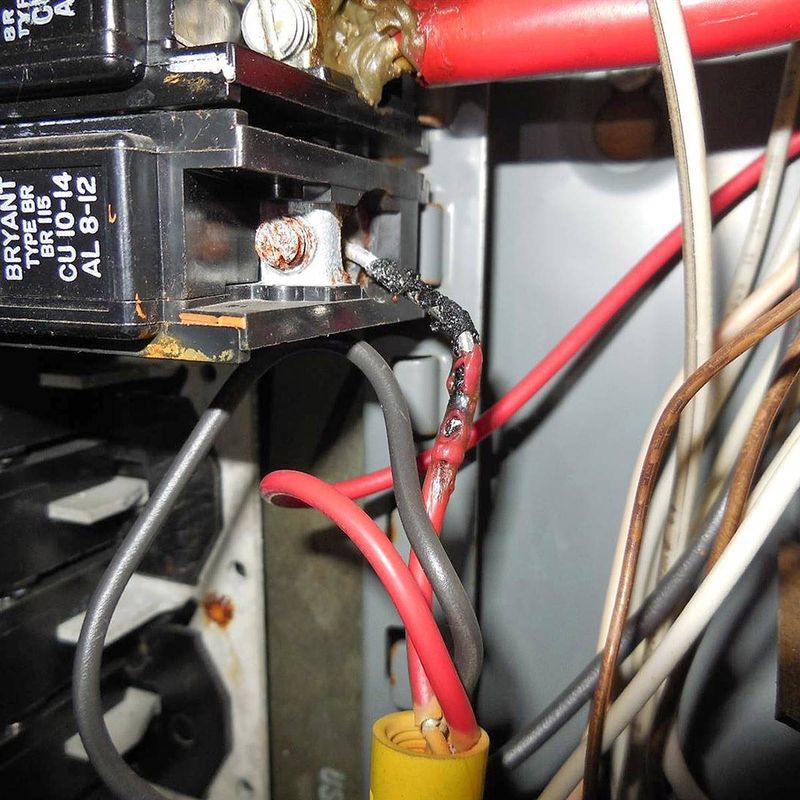

5. Outdated Electrical Systems

Old-school charm comes with a side of outdated electrical systems which can cause sparks to fly, but not in a good way. Insurers are concerned about the fire hazards posed by these vintage setups.

While retro might be trendy, old wiring increases insurance risk assessments. Bringing your electrical system into the modern age can save you from shocking premium increases.

It’s wise to invest in updates before your insurance company pulls the plug on reasonable rates. Safety, after all, is a current priority.

6. Aluminum Wiring

Aluminum wiring was once the toast of the town for its affordability which made it a popular choice. Insurers now raise eyebrows at homes with this wiring due to increased fire risks.

Corrosion and overheating are common problems that can spark a premium surge. The shine of aluminum fades when faced with potential danger.

Updating to copper wiring, though costly, may reduce risks and keep your insurance costs grounded. When it comes to wiring, playing with fire is never a good idea.

7. Solar Panels

Harnessing the sun’s energy is undoubtedly a bright idea which can slash energy bills. Yet, insurers might cast a shadow on your solar dreams.

Installation risks and potential damage from weather events add complexity to coverage. Though eco-friendly, solar panels can sometimes lead to unexpected premium hikes.

It’s crucial to ensure that your installation complies with safety standards. After all, harnessing the power of the sun should illuminate savings rather than casting a cloud over your finances.

8. Oil Tanks

Oil tanks once signified a reliable home heating source which kept the cold at bay. Today, insurers view them as environmental hazards due to potential leaks.

The risk of contamination can lead to steep premium increases. While nostalgia for the past is understandable, outdated oil tanks can be costly.

Regular inspections and upgrades can prevent leaks and reduce insurance costs. In the world of home heating, it’s often better to be safe than sorry.

9. Flat Roofs

Flat roofs offer a unique architectural flair that sets a home apart from the crowd. However, insurers may not share the enthusiasm due to drainage issues.

Water pooling can lead to damage that sends premiums sky-high. Despite their stylish appeal, flat roofs need diligent maintenance to avoid becoming a financial burden.

Regular checks ensure your roof remains in good shape. Remember, a flat surface should not translate to flatlining your wallet.

10. Unfenced Yards

Open space is a breath of fresh air for both owners and pets who appreciate the freedom. Yet, insurers might see an unguarded invitation for accidents or unwelcome visitors.

Unfenced yards can lead to liability claims that bump up premiums. Consider adding a fence to define boundaries and offer peace of mind.

It might just save you from having your finances run wild. A little barrier can go a long way in protecting your pocket.

11. Aggressive Dog Breeds

Dogs are often considered part of the family which fill homes with joy and love. Yet, some breeds raise eyebrows with insurers due to perceived aggressive tendencies.

This can lead to higher premiums that reflect potential liability claims. Understanding breed restrictions and ensuring proper training can help mitigate risks. It’s not about the breed but how you nurture and care for them. A wagging tail should bring happiness, not stress to your insurance policy.

12. Finished Basements

Turning a basement into a functional living space adds value and comfort that transforms your home’s potential. Insurance companies, however, might see increased risk of water damage which can affect coverage.

Finished basements require extra caution to prevent leaks that could lead to costly repairs. Waterproofing and regular inspections keep the space safe and premiums manageable.

After all, a finished basement should be an asset rather than a flood of financial woes.

13. Detached Structures

Extra space is always appealing that offers storage or additional living options. Detached structures like sheds or garages can, however, complicate insurance policies.

Insurers may view them as separate risks which can increase premiums. Ensuring these structures are well-maintained and secure helps in keeping costs down.

They should complement your property, not complicate your coverage. It’s all about balancing space and security without inflating your insurance bill.

14. Smart Home Devices

Embracing technology makes life easier that brings homes into the future. Yet, the intersection of smart devices and insurance can be a tricky terrain.

Security flaws and cyber threats might concern insurers, potentially raising premiums. Regular updates and robust security measures keep your smart home safe and costs stable.

Being tech-savvy is great, but ensure your digital security matches the sophistication of your gadgets. It’s smart to be savvy when it comes to premiums.

15. Luxury Renovations

Transforming your home into a palace is tempting which adds opulence and comfort. However, luxury renovations can lead insurers to reassess your property’s value.

Expensive upgrades often result in increased premiums to cover potential replacements. It’s crucial to ensure your coverage matches the enhancements.

Luxurious doesn’t have to mean a financial burden if you’re prepared. Renovate wisely to enjoy the finer things without an exaggerated insurance cost.

16. Waterfront Locations

The serenity of living by water is unmatched that offers breathtaking views and tranquility. Nonetheless, waterfront properties come with unique challenges insurers can’t ignore.

Flood risks and erosion issues can lead to substantial premium increases. Understanding these risks and investing in proper protections is key.

A waterfront view is a luxury that shouldn’t wash away your finances. Balancing enjoyment and security ensures that your dream location doesn’t become a nightmare.