10 Types Of Homes That Will Probably Be Cheaper By The End Of 2025 (Plus 6 That Should Be Your Go-to)

The housing market feels like a giant game of musical chairs lately, and not every home’s going to keep a seat. I’ve been keeping an eye on shifting trends, and between rising climate concerns, economic shakeups, and what buyers actually want now, it’s clear that the real estate landscape is in for a shake-up.

Some properties are about to lose value fast while others are quietly becoming the new MVPs of smart investing. If you’re thinking about buying, selling, or just curious where things are headed, now’s the time to learn which homes are falling out of favor, and which are rising stars.

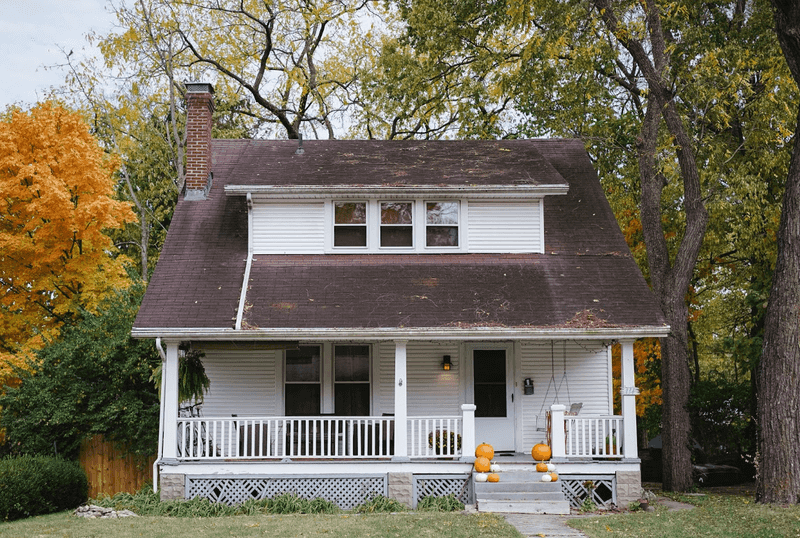

1. McMansions From The 80s And 90s

Remember when bigger meant better? Those days are officially over for McMansions built between 1980 and 2010. Baby boomers are downsizing faster than you can say “empty nest,” while millennials prefer cozy spaces over cavernous rooms.

Utility bills for these giants are becoming scarier than horror movies. High maintenance costs combined with soaring energy prices make these homes financial nightmares. Where once stood symbols of success now sit white elephants that nobody wants to feed.

2. Coastal Properties Without Flood Protection

Living by the water sounds dreamy until insurance companies start treating your home like a sinking ship. Coastal properties lacking proper flood mitigation are becoming financial liabilities faster than rising sea levels.

Climate-conscious buyers now scrutinize flood histories like detective novels. Insurance premiums are skyrocketing, making waterfront living a luxury few can afford. Sometimes the most beautiful views come with the ugliest price tags when Mother Nature sends her bills.

3. Car-Dependent Suburban Developments

Gas prices aren’t the only thing driving people away from car-dependent suburbs. Remote work has flipped the script on commuting, making those hour-long drives feel like ancient torture methods.

Modern buyers want walkable neighborhoods where coffee shops and grocery stores are steps away, not miles. Suburban developments built around car culture are finding themselves stranded without buyers. Though spacious, these homes are becoming islands in a sea of changing preferences.

4. Homes In High Wildfire Risk Zones

Fire season used to be a calendar event, now it feels like a year-round threat. Properties in wildfire zones are getting the cold shoulder from buyers who prefer their investments flame-free.

Insurance companies are dropping policies faster than hot potatoes, leaving homeowners scrambling for coverage. Environmental concerns are reshaping buyer priorities, making fire-prone areas less desirable. How ironic that homes with the most scenic mountain views are becoming the hardest to sell.

5. Energy-Inefficient Older Homes

Drafty windows and ancient heating systems are becoming deal-breakers in today’s energy-conscious market. Rising utility costs make inefficient homes feel like money pits with endless appetites.

Younger buyers prioritize sustainability over charm, viewing energy-guzzling properties as environmental villains. Though these homes might have character, their outdated systems are characters nobody wants to live with. Sometimes old-world charm comes with new-world problems that modern wallets can’t handle.

6. Oversized Luxury Condos In Declining Urban Areas

Urban flight isn’t just affecting office buildings; luxury condos in declining city centers are feeling the pinch too. Remote work has untethered people from urban anchors, making downtown living less essential.

Oversized units that once symbolized urban success are becoming harder to fill. Rising crime rates and reduced amenities make these properties less appealing. Where bustling city life once justified premium prices, ghost-town vibes are driving values down faster than elevators in these towers.

7. Homes With Outdated Smart Home Technology

Remember when having any smart home tech made you cutting-edge? Now outdated systems make homes feel more ancient than advanced. Technology evolves faster than fashion trends, leaving early adopters with obsolete gadgets.

Incompatible systems and discontinued support turn smart homes into expensive puzzles. Buyers prefer homes with current technology or clean slates for modern installations.

Though pioneers in home automation, these properties are becoming cautionary tales about betting on yesterday’s tomorrow.

8. Properties With Extensive Lawns And High Water Needs

Sprawling green lawns are becoming as outdated as gas-guzzling cars in our water-conscious world. Drought conditions and rising water costs make thirsty landscapes expensive hobbies few can afford.

Eco-minded buyers prefer xeriscaping and native plants over water-hungry grass. Maintenance costs for large lawns are growing faster than the grass itself.

Sometimes the American dream of a perfect lawn becomes a nightmare when water bills arrive monthly.

9. Isolated Rural Properties Without Reliable Internet

Peaceful country living loses its charm when your internet moves slower than molasses. Remote work demands reliable connections, making digital dead zones less desirable than ever before.

Urban refugees seeking rural retreats still need modern connectivity for work and entertainment. Properties without fiber optic access are becoming digital dinosaurs in an online world.

Though surrounded by natural beauty, homes without reliable internet are becoming islands in the information age.

10. Homes Near Declining Shopping Malls

Shopping malls are becoming modern ghost towns, dragging nearby property values down with them. Once-thriving commercial centers now look like abandoned movie sets from dystopian films.

Online shopping killed the mall star, leaving surrounding neighborhoods without their economic anchors. Properties that once benefited from mall proximity now suffer from their decline.

How quickly yesterday’s convenience becomes today’s eyesore when retail landscapes shift beneath our feet.

1. Historic Homes With Character And Charm

Stepping into a historic home feels like traveling through time, and buyers are paying premium prices for these journeys. Unique architectural details and craftsmanship that modern builders can’t replicate make these properties increasingly valuable.

Scarcity drives demand, and they’re not making any more historic homes. Central locations and established neighborhoods add to their appeal.

Where mass-produced houses blend together, historic properties stand out like rare gems in a sea of ordinary stones.

2. Multifamily Properties Near Transit Hubs

Rental income and appreciation potential make multifamily properties the golden geese of real estate investing. Duplexes and triplexes near transportation hubs are particularly hot commodities in today’s market.

Urban density and walkability are driving demand for these versatile properties. Rent growth continues outpacing inflation, creating steady income streams for owners.

Sometimes the best investments are the ones that house multiple dreams under one roof while generating multiple revenue streams.

3. Sustainable And Eco-Friendly Homes

Green homes are no longer just environmentally friendly; they’re wallet-friendly too. Carbon-neutral properties with passive solar design are becoming the crown jewels of conscious living.

Younger generations prioritize sustainability over size, driving demand for eco-conscious properties. Energy savings and environmental benefits create long-term value that traditional homes can’t match.

Where conventional homes consume resources, sustainable properties generate their own power and peace of mind for environmentally aware buyers.

4. Assisted Living And Senior Housing Facilities

Baby boomers retiring in record numbers are creating unprecedented demand for senior housing. Assisted living facilities are becoming gold mines as demographics shift toward an aging population.

Supply can’t keep pace with demand, especially in desirable retirement destinations. Values could rise 7-12% annually as more seniors seek care facilities. Sometimes the most profitable investments are the ones that serve society’s growing needs while generating substantial returns.

5. Furnished Apartments And Move-In Ready Condos

Convenience is king in today’s fast-paced world, making furnished units incredibly appealing to busy professionals and relocating families.

Move-in ready properties eliminate the hassle of furniture shopping and decorating decisions. Some markets have seen furnished properties appreciate over 15% year-over-year.

Low-maintenance living appeals to people prioritizing experiences over possessions. How refreshing to find homes where the hardest decision is which streaming service to choose, not which sofa to buy.

6. Properties With Accessory Dwelling Units (ADUs)

ADUs are like having your cake and eating it too – extra space for family or rental income for financial flexibility. These versatile additions transform single properties into dual-income opportunities.

Housing affordability challenges make ADUs increasingly valuable for multi-generational living or rental income. Home offices, guest quarters, or rental units provide options that adapt to changing needs.

Sometimes the smallest additions create the biggest impacts on property values and lifestyle flexibility.