15 Things You Need To Know About Buying A Second Home In USA

Buying a second home in the USA can be an exciting adventure that opens up new possibilities for vacation getaways, investment opportunities, and future retirement plans.

Whether you’re dreaming of a beachfront condo, a mountain cabin, or a desert retreat, there’s a lot to consider before taking the plunge. Understanding these key factors will help you make a smart purchase that brings joy rather than headaches.

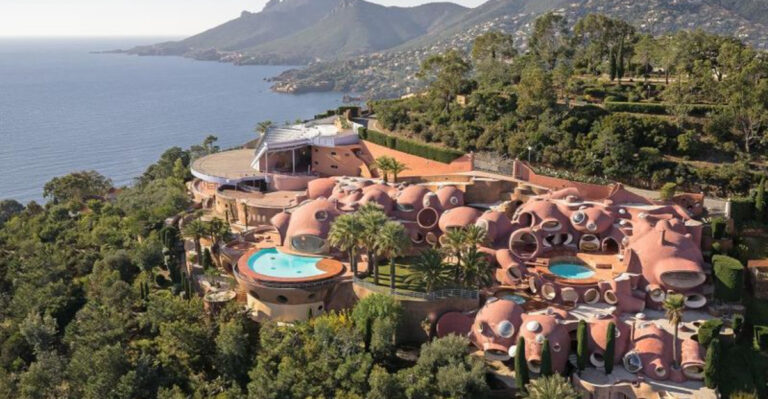

1. Location Is Everything

Picking the perfect spot means thinking beyond vacation vibes. Consider year-round accessibility, nearby amenities, and future growth potential of the area.

Beach houses might seem dreamy, but hurricane zones bring higher insurance costs. Mountain cabins offer solitude but might be inaccessible in winter months. The golden rule? Buy where you’ll actually go or where others want to rent—not just where looks pretty in photos.

2. Mortgage Rates Hit Different

Lenders view second homes as riskier investments than primary residences. Expect to pay 0.5-1% higher interest rates and bring a larger down payment to the table—typically 20-30%. Your debt-to-income ratio will face stricter scrutiny.

Lenders want to ensure you can handle two mortgages simultaneously without breaking a sweat. Shop around extensively; even small rate differences create thousands in savings over the loan’s lifetime.

3. Tax Implications Can Be Tricky

Property taxes vary dramatically by state and county. Florida and Texas might offer lower income taxes, but their property taxes could shock your wallet.

The 2017 Tax Cuts and Jobs Act limited mortgage interest deductions on second homes. You can only deduct interest on total mortgage debt up to $750,000 across all properties. State income taxes apply if you rent out your property, even if you don’t live in that state!

4. Cash Flow Realities

Monthly expenses extend far beyond the mortgage payment. Budget for property taxes, homeowners insurance, utilities, HOA fees, and regular maintenance—even when you’re not there. Many second-home owners underestimate ongoing costs by 25-40%.

Create a separate savings account specifically for property expenses and emergencies. Remember seasonal fluctuations: winter heating in mountain homes or summer AC in desert properties can create shocking utility bills.

5. Rental Income Possibilities

Renting your second home can offset ownership costs dramatically. Popular vacation destinations might generate $20,000-$50,000 annually through platforms like Airbnb or VRBO. Research local regulations first—many communities have strict short-term rental restrictions or outright bans.

6. Insurance Needs Expand

Standard homeowners policies don’t cut it for second homes. You’ll need specialized coverage that addresses vacancy periods, rental usage, and location-specific risks.

Coastal properties require separate flood insurance policies that can cost thousands annually. Mountain homes might need additional wildfire protection or snow damage coverage.

If renting your property, landlord insurance becomes essential—it covers liability issues and lost rental income during repairs.

7. Property Management Headaches

Long-distance ownership creates unique challenges. Who checks on your property after storms? Who handles emergency repairs when you’re hundreds of miles away?

Professional management companies charge 8-12% of monthly rent for long-term rentals or 20-30% for vacation rentals. Their services include marketing, tenant screening, maintenance coordination, and rent collection.

Alternatively, building relationships with local handymen, cleaners, and neighbors creates an informal support network.

8. HOA Restrictions Can Surprise You

Homeowner associations govern many vacation communities with iron fists. Rules can limit everything from exterior paint colors to how many cars you can park overnight.

Rental restrictions are particularly important to investigate. Some HOAs prohibit short-term rentals entirely or require minimum stay periods of 30+ days.

Beyond monthly fees, be prepared for special assessments—unexpected charges for major repairs that can run into thousands of dollars with little warning.

9. Financing Options Beyond Traditional Mortgages

Home equity loans on your primary residence can fund second home purchases, often at lower interest rates than traditional second-home mortgages. This strategy leverages existing equity but puts your primary home at risk.

1031 exchanges allow investors to sell one investment property and buy another while deferring capital gains taxes. The rules are complex but can save tens of thousands in taxes. Self-directed IRAs can even purchase real estate, though strict rules apply.

10. Future Resale Value Considerations

Vacation home markets fluctuate more dramatically than primary residence markets. During economic downturns, luxury and second homes often see the steepest price drops.

Properties with unique features like waterfront access or mountain views generally hold value better. Conversely, homes in oversaturated developments may struggle to stand out when it’s time to sell.

Buy in established areas with proven track records rather than speculative up-and-coming locations if resale value is a priority.

11. Furnishing Costs Add Up

Setting up a second home from scratch requires significant investment beyond the purchase price. Expect to spend 15-25% of the property value on furniture, appliances, and essentials.

Many buyers underestimate these costs, especially for larger vacation homes. Everything from kitchen utensils to bedding must be duplicated.

Consider turnkey properties that come fully furnished—they typically command 10-20% price premiums but eliminate the hassle of furnishing remotely.

12. Seasonal Maintenance Requirements

Vacant properties deteriorate faster than occupied ones. Winterizing is crucial for northern locations—pipes must be drained to prevent freezing and bursting during cold months.

Coastal properties need hurricane preparations and regular checks for salt air corrosion. Desert homes require special attention to cooling systems and pest control during hot seasons.

Creating a seasonal maintenance calendar with automatic service appointments ensures nothing falls through the cracks during your absence.

13. Distance Management Strategies

Smart home technology has revolutionized remote property management. Wi-Fi thermostats, doorbell cameras, and water leak detectors provide peace of mind from anywhere.

Local support networks are equally important. Cultivate relationships with neighbors who can perform visual checks during storms or alert you to suspicious activity.

Consider reciprocal arrangements with other second-home owners—you watch their place during certain months, they watch yours during others.

14. Long-Term Investment Potential

Second homes can serve as retirement planning vehicles. Buying in your dream retirement location years in advance lets you lock in today’s prices and get to know the area gradually.

Some buyers use vacation homes as test drives for permanent relocation. Weekend visits over several years reveal whether you truly love a location enough to move there full-time.

Family legacy properties create multi-generational gathering places that appreciate in both financial and emotional value over decades.

15. Legal Structure Considerations

How you hold title to your second home affects everything from liability exposure to inheritance plans. LLCs provide liability protection but complicate mortgage qualification and may trigger higher property taxes.

Creating a trust specifically for the property can facilitate smooth inheritance transitions without probate.Consult both real estate and estate planning attorneys before deciding on the optimal ownership structure.